The startup guide to customer research: How to actually understand your market

Most startups skip customer research, or they do a half-hearted job of it. I get it. There are fires to put out, investors to charm, and a never-ending to-do list. But without solid customer research, you’re marketing in the dark.

Whether you’re pre-launch or scaling fast, understanding your market isn’t a nice-to-have - it’s your competitive edge.

Let’s look at how to actually get to know your customers – minus the jargon and fluff.

Why bother with customer research?

Good research helps you:

Build products people actually want.

Craft messaging that resonates.

Save money by avoiding marketing guesswork.

Shorten sales cycles.

Startups that nail customer research spot gaps, position themselves better, and win trust faster. It’s that simple.

The 3 types of customer research startups need

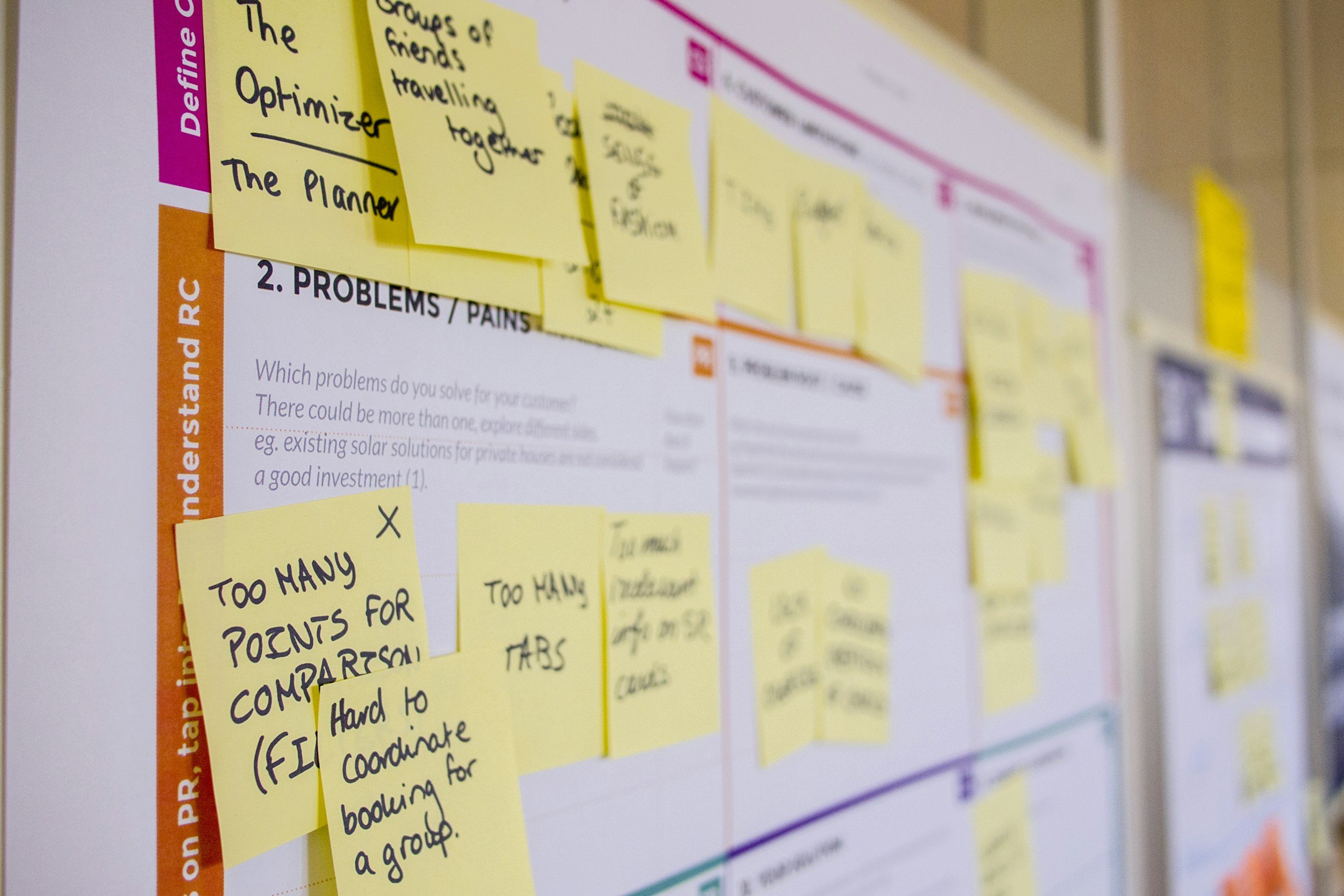

1. Qualitative research

This is your deep-dive stuff – interviews, focus groups, conversations. It gives you context and emotional nuance. Why did someone choose you over a competitor? What’s frustrating them?

2. Quantitative research

This is your numbers game – surveys, polls, analytics data. It gives you scale. Are 80% of your users dropping off at checkout? Is pricing your main blocker?

3. Desk research

Look at existing data – online reviews, competitor case studies, Reddit threads. What’s the chatter in your niche? What do people love or hate about similar offerings?

Where startups go wrong

Relying on assumptions: “I know my customer” – until you actually ask them.

Over-indexing on one method: Only running surveys, without qualitative depth.

Paralysis by analysis: Spending months in ‘research mode’ but never applying the insights.

How to actually do customer research

Step 1: Talk to real people

Grab 5-10 target customers and have honest conversations. No pitch. Just curiosity. Use open-ended questions like:

What’s your biggest challenge when it comes to X?

What have you tried before? What worked, what didn’t?

What would the perfect solution look like?

Step 2: Validate with data

Run a short survey based on what you heard. Keep it under 10 questions. Validate trends: Is that pain point common? Are people willing to pay to solve it?

Step 3: Snoop (ethically)

Dive into forums, reviews, and social media to see what people are really saying about your space. What are the recurring complaints? What language do they use?

Step 4: Map the journey

Sketch out how people find you, what makes them hesitate, and where they drop off. That’s where you focus your fixes.

Pro tips

Don’t outsource this too early – founders and marketers should hear the raw feedback firsthand.

Record interviews (with permission) so you don’t miss golden insights and can refer back to them.

Look for emotional drivers – fear, frustration, ambition. They’re your messaging goldmine.

Make a note of their language - reflect their own words back to them in your marketing and they'll feel heard and understood.

In short

Customer research doesn’t have to be complicated. But skipping it? That’ll cost you far more in wasted time and missed opportunities.

Do it well, and you’ll find your product fits faster, your marketing works harder, and your brand stands out.

Need help turning research into sharper positioning and marketing? Book in a call with me today.